Join Yonder for debit or credit card and receive a fantastic welcome package! You’ll get £10 off your first purchase, three months free membership, and up to 10,000 welcome points. This offer is applied automatically when you sign up, no code is needed.

Yonder Deals for November 2025

Yonder is revolutionising the way UK consumers approach everyday spending by blending the convenience of debit and credit cards with a rewarding membership model focused on dining, travel, and curated experiences. This innovative financial platform empowers users to turn routine purchases into extraordinary rewards, offering a seamless way to earn and redeem points without the hassle of traditional banking limitations. Whether you’re jetting off abroad or enjoying a local meal, Yonder ensures your money works harder for you, delivering value-packed perks that enhance your lifestyle.

What is Yonder?

Yonder is a dynamic financial membership service that combines the reliability of Mastercard with a unique rewards ecosystem designed for modern spenders. Think of it as the love child of agile digital banks like Monzo and premium card providers like Amex, but tailored specifically for those who crave meaningful rewards on real-life expenses. Launched to simplify financial management, Yonder provides debit and credit cards that let you earn points on every purchase, which you can then redeem for handpicked experiences in dining, travel, shopping, and entertainment.

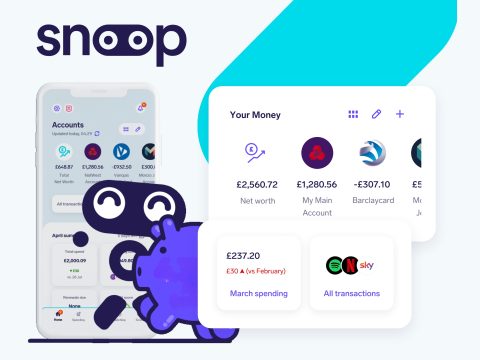

At its core, Yonder operates as a rewards-driven platform where members sign up for free and choose from various card options to suit their spending habits. The service emphasises transparency and ease, with an award-winning app that handles everything from real-time notifications to seamless point redemptions. For UK customers, this means no more points gathering dust—instead, they unlock tailored perks that align with their passions, making every transaction feel rewarding.

What sets Yonder apart is its focus on curated, rotating rewards that keep things fresh and exciting. From airport lounge access to exclusive dining deals, the platform ensures members get the most out of their money. With acceptance at over 44 million locations worldwide, Yonder is your go-to for borderless spending backed by robust security and customer support.

Products and Services

Yonder offers a versatile lineup of debit and credit cards, each designed to cater to different levels of spending and perks. The Free Debit Card provides a straightforward entry point with 1x points on purchases and no foreign exchange fees abroad, ideal for everyday use without any monthly commitment. For those seeking more, the Full Debit Card steps it up with 4x points earning potential, plus added benefits like travel insurance, all accessible via a simple top-up system.

On the credit side, the Free Credit Card mirrors the debit version’s accessibility, earning 1x points with no fees on overseas spends and no monthly fee. The Full Credit Card, however, is the premium choice, boasting 5x points on eligible purchases, comprehensive travel insurance, and enhanced redemption options. All cards integrate seamlessly with the Yonder app, allowing users to top up accounts, freeze cards instantly, or even split bills with friends.

Beyond cards, Yonder excels in its rewards marketplace, where points translate directly into real-world value. You can redeem for flights on any airline, airport lounge bookings, cashback, or exclusive experiences that rotate monthly to keep offerings fresh. This holistic approach makes Yonder not just a card provider, but a complete financial companion for discerning users.

Key Features

One of the standout features of Yonder is its no foreign exchange fees policy, using the pure Mastercard exchange rate for international spends—perfect for UK travellers avoiding hidden costs. The points system is intuitive: earn on every purchase, whether it’s coffee at a local spot or groceries at Sainsbury’s, and redeem effortlessly via the app for high-value rewards. Real-time notifications and spend breakdowns give you full control, while the ability to send points to friends adds a social twist.

Travel perks are a highlight, including comprehensive insurance coverage on premium cards and easy lounge access, ensuring stress-free journeys. The app’s top-notch support means help is always a tap away, with features like instant card replacement enhancing security. Additionally, rotating monthly rewards in categories like dining and entertainment keep the excitement alive, preventing points from expiring unused.

For tech-savvy users, the seamless integration across devices makes managing finances a breeze. Whether you’re swiping for points or withdrawing funds, Yonder prioritises user-friendly design without compromising on robust protections. These elements combine to create a platform that’s as reliable as it is rewarding.

Benefits

Choosing Yonder means unlocking tangible savings on everyday spends, with potential annual rewards valued at hundreds of pounds based on your habits—for instance, up to £342 back on dining or £414 on shopping for moderate users. The absence of FX fees alone can save travellers significant amounts, while the high earning rates on premium cards maximise returns on larger purchases. Customers appreciate the flexibility to redeem points as they wish, turning routine expenses into memorable experiences without complex terms.

UK shoppers benefit from the platform’s focus on local and international value, with no monthly fees on free tiers making it accessible for all budgets. The community aspect, like sharing points or splitting bills, fosters a sense of connection, while the app’s insights help track and optimise spending. Overall, Yonder delivers peace of mind through its transparent APR explanations and customer-centric design, ensuring you get more from your money.

Looking to amplify these benefits even further? BudgetFitter is an invaluable tool for UK consumers tracking the latest deals and discounts on services like Yonder. Through the BudgetFitter website, browser extension, or mobile app, you can uncover exclusive promotions and savings opportunities that complement your rewards earning, helping you stretch every pound.

History and Background

Yonder emerged as a forward-thinking fintech player in the UK market, founded with the mission to disrupt traditional banking by prioritising rewards that matter. Drawing inspiration from the digital banking revolution, the company quickly gained traction for its user-focused innovations, blending Mastercard’s global reach with bespoke perks. Over the years, Yonder has evolved from a niche rewards card to a comprehensive membership service, earning accolades for its app and overall experience.

The brand’s growth reflects a commitment to listening to users, expanding offerings based on feedback to include more travel and lifestyle integrations. Today, Yonder stands as a trusted name among millions of users, continually refining its platform to stay ahead in the competitive fintech landscape. Its roots in the UK ensure a deep understanding of local needs, from seamless GBP transactions to tailored reward categories.

Special Offers and Savings

New members to Yonder can kick off their journey with an attractive welcome bonus, such as £10 back on your first spend, making it easier than ever to start earning. Ongoing promotions often include enhanced points multipliers on specific categories like travel or dining, allowing you to rack up rewards faster. For savvy savers, the platform’s rotating deals provide opportunities to redeem points at premium rates, such as discounted flights or entertainment tickets.

Yonder’s savings model shines in its fee-free international spending and flexible redemptions, potentially saving users up to 3-5% on overseas transactions compared to standard cards. Seasonal offers might boost earnings on airport lounges or shopping, ensuring year-round value. To maximise these, pair Yonder with deal-hunting resources that spotlight the best timings for sign-ups or redemptions.

With no lock-in contracts and the option to upgrade tiers as your needs change, Yonder promotes long-term savings without pressure. Whether you’re a frequent flyer or a foodie, these offers transform ordinary spending into extraordinary gains, solidifying Yonder as a top choice for budget-conscious yet reward-hungry consumers.