Alternatives to Tetrad

Explore similar brands to find the perfect deal for your needs.

About Tetrad

Tetrad—formerly known as WSLRemit—operates as a digital-first money transfer and financial services provider, simplifying the cross-border remittance process for both individuals and businesses. By concentrating on transparent fees, user-friendly tools, and secure systems, Tetrad aims to remove the complexities and hidden costs typically seen with traditional banking or legacy remittance channels. Serving a global audience—ranging from immigrants supporting family members, to businesses paying international vendors—Tetrad offers a flexible approach to cross-border payments that prioritises cost-effectiveness and efficiency.

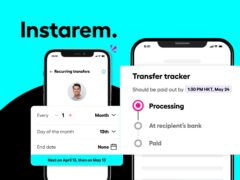

At the core of Tetrad is a determination to streamline global remittances. Their platform (accessible via website and app) provides instant currency quotes, a choice of payout methods (bank deposits, mobile wallets, or cash pickups), and multi-lingual support. Recognising that user trust hinges on consistency and clarity, Tetrad discloses all relevant fees before transactions are finalised, ensuring no unpleasant surprises. The result: faster payments—often delivered within hours or by the next business day—plus rates that frequently surpass what’s offered by conventional banks.

Key Features of Tetrad:

- Coverage: Tetrad supports money transfers primarily to parts of Africa, Asia, and Latin America, backed by local partnerships that enable broad recipient networks.

- Flexible Payout: Depending on the region, recipients can retrieve funds through bank accounts, mobile wallets, or third-party agents for cash pickup.

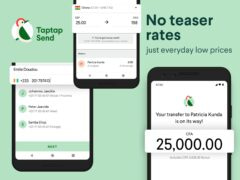

- Transparent Pricing: Real-time exchange rate quotes empower users to confirm the final sum before sending. The emphasis on clarity means users rarely face hidden or inflated fees.

- Rapid Transfers: Transactions often complete in hours or by the next day—a stark contrast to multi-day waits typically seen in traditional banking.

- Compliance & Security: Rigorous KYC (Know Your Customer) checks and anti-money laundering protocols fortify user data, though first-time customers might experience a brief delay for identity verification.

Beyond transfers, Tetrad’s platform includes convenience features—like notifications for transfer status updates, plus dashboards allowing easy reference to transaction histories. Engaged customer support, reachable via chat, email, or phone, helps solve potential issues swiftly (for example, unprocessed payments or difficulties finalising a transfer).

Potential Drawbacks:

- Coverage Gaps: Not all countries or remote areas have robust partner networks, necessitating checking Tetrad’s coverage pages in advance.

- Transfer Limits: Users may run into daily or monthly caps as part of compliance, impacting large-sum remittances.

- Rate Fluctuations: Real-time quotes can expire; delays in completing the payment might alter rates or require updated quotes.

- Onboarding: Verification processes might slow first-time usage, but these steps are standard in remittance services for security and regulatory compliance.

Tips for Using Tetrad:

- Compare Rates: For major or regular transfers, weigh Tetrad’s fees and rates against other providers to guarantee ongoing value.

- Keep Track: Monitor transfer progress through Tetrad’s notification system or dashboard, thus ensuring recipients know when to expect money.

- Mind Limits & Promos: Understand monthly/daily transfer limits and remain alert for discount codes or promotional offers.

- Plan for Large Sums: If sending substantial amounts, gather details early (recipient ID, bank info, etc.) and confirm Tetrad’s or partner banks’ capacity to handle that transaction smoothly.

In essence, Tetrad stands as a convenient, transparent, and cost-efficient solution for cross-border remittances. Designed to serve varied needs—from family support to business transactions—its digital-first design shortens wait times, lessens paperwork, and champions straightforward user experiences. While coverage or compliance procedures might pose limitations, most find Tetrad a forward-thinking alternative to older, pricier services, enabling them to manage global transfers swiftly and securely. For those seeking a streamlined way to send funds internationally at competitive rates, Tetrad remains a compelling choice in the dynamic remittance landscape.