Get a £5 bonus on your first transfer with a Taptap Send promo code. Send money abroad and enjoy an extra reward on your first transaction!

Taptap Send Deals for November 2025

In a world where staying connected with loved ones across borders is essential, Taptap Send emerges as a reliable solution for seamless money transfers. Whether you’re supporting family in distant lands or sending funds quickly without the hassle, this innovative service makes international remittances straightforward and affordable. Discover how Taptap Send empowers users from the UK and beyond to send money effortlessly to regions like Africa, Asia, and Latin America.

What is Taptap Send?

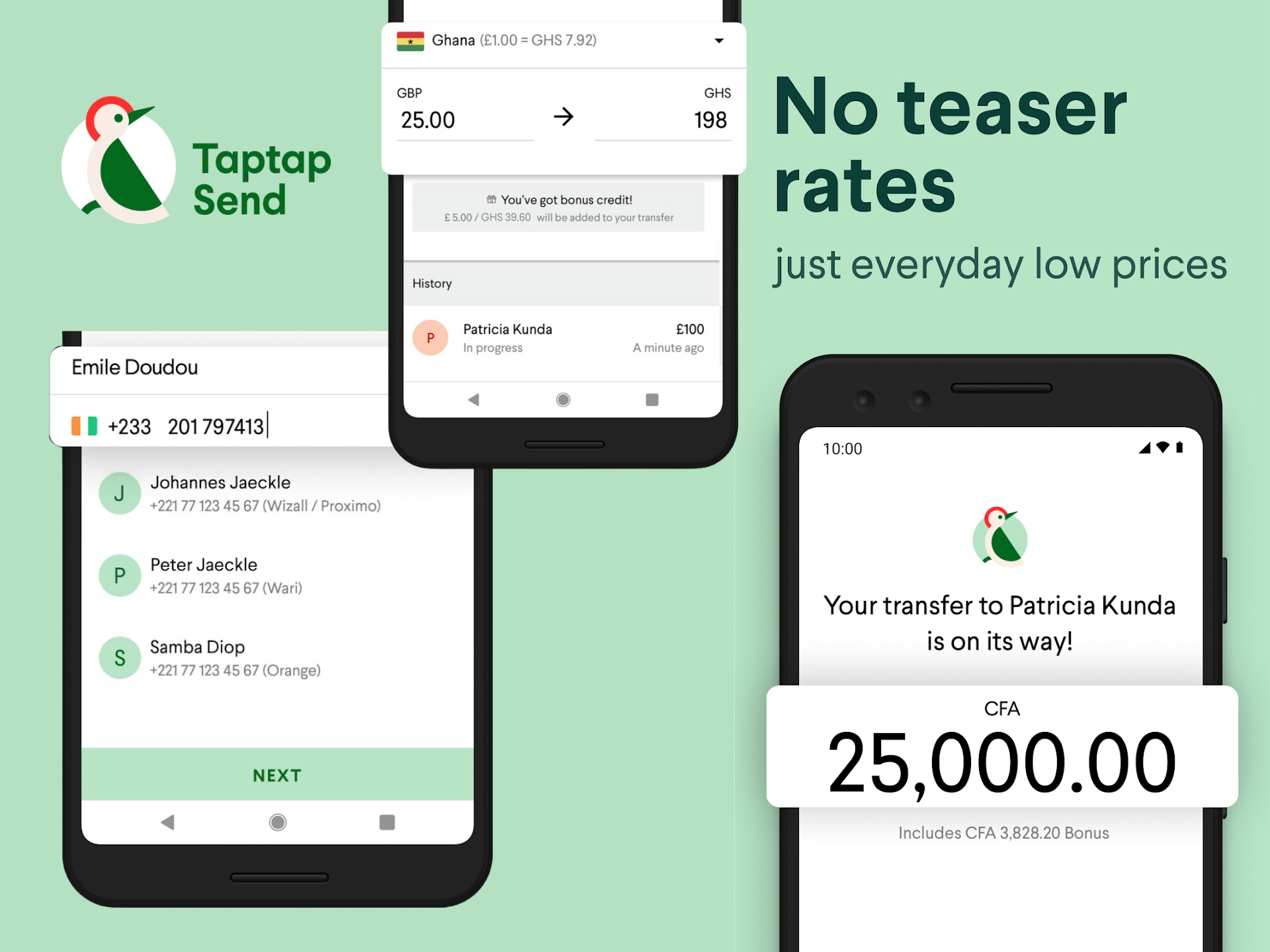

Taptap Send is a user-friendly money transfer platform designed to help individuals send funds from countries such as the UK, EU, US, UAE, Canada, and Australia to recipients in Africa, Asia, the Caribbean, and Latin America. With a focus on speed and convenience, it allows you to transfer money directly to mobile money wallets using just a smartphone. This service stands out by offering fast transfers at competitive rates, eliminating the need for long queues or traditional banking delays.

At its core, Taptap Send leverages mobile technology to make sending money as simple as sending a text message. You provide your friend’s name and mobile number, and the funds are deposited immediately from your debit card into their wallet. Available in multiple languages including English, Français, Deutsch, Español, and Italiano, it caters to a diverse global audience seeking efficient financial solutions.

The platform boasts high user satisfaction, as evidenced by positive feedback on Trustpilot, where customers praise its affordability and ease of use. Whether you’re in the UK sending to Ghana or from France to Senegal, Taptap Send ensures your transfers are secure and hassle-free, with more countries added regularly to expand its reach.

Products and Services

Taptap Send primarily offers a mobile app-based service for international money transfers, enabling users to send funds to popular mobile money networks across various regions. From the UK, you can dispatch money to destinations like Nigeria, Kenya, Ethiopia, and many more, with support for currencies such as GBP, EUR, USD, and AED. The service covers an extensive list of countries, including those in Africa like Benin, Burkina Faso, and Zimbabwe, as well as Asian nations such as Bangladesh, India, and the Philippines.

Key destinations include Latin American countries like Brazil, Colombia, and Mexico, alongside Caribbean spots such as Jamaica and Haiti. For users in Europe, transfers are possible from Austria, Belgium, Germany, and others, while North American senders from the US and Canada benefit from similar accessibility. The platform is expanding, with new countries like Fiji, Jordan, and South Korea marked as “coming soon,” promising even broader coverage in the future.

- Mobile Money Transfers: Direct deposits to wallets on networks in over 30 countries, making it ideal for recipients without traditional bank accounts.

- Multi-Currency Support: Send from major currencies to local ones, with real-time rates displayed, such as conversions from AED to BDT.

- App-Based Service: Available for smartphones, supporting debit card payments for instant processing without physical visits.

Key Features

What sets Taptap Send apart is its emphasis on simplicity and speed, allowing you to complete transfers with just a few taps on your phone. The app requires minimal information—just the recipient’s name and mobile number—to initiate a send, depositing funds directly into their mobile money wallet. This no-hassle approach means no more uncertainty about whether your money has arrived, as transfers are immediate and trackable.

Security is a top priority, with robust measures ensuring safe transactions every time you use the service. Users appreciate the great rates offered consistently, helping you send more while spending less on fees. Additionally, the platform provides notifications for new country availability, keeping you informed about expansions that could benefit your transfer needs.

Customer testimonials highlight the app’s reliability, with one user noting, “My experience with Taptap Send has been good—and cheap!” Another shared, “I use it to send money to my family. Even when I was in Ivory Coast,” underscoring its versatility for both senders and occasional recipients. These features make Taptap Send a go-to choice for frequent international remitters.

Benefits

Choosing Taptap Send means enjoying convenient, safe, and fast money transfers that save you time and money compared to traditional methods. UK customers, in particular, benefit from low-cost options when sending to popular destinations like Ghana, Nigeria, or India, with rates that allow you to maximise the amount received by your loved ones. The app’s intuitive design ensures even first-time users can navigate it effortlessly, reducing stress during urgent sends.

One major advantage is the focus on mobile money, which is widely used in developing regions, enabling recipients to access funds quickly without banking infrastructure. You’ll also appreciate the transparency in exchange rates, displayed in real-time, helping you plan transfers effectively. For those looking to maximise savings on Taptap Send transactions, BudgetFitter is an invaluable tool—track the latest deals and discounts through the BudgetFitter website, browser extension, or mobile app to ensure you’re always getting the best value on your remittances.

Overall, the benefits extend to peace of mind, knowing your transfers are secure and reliable, as backed by positive user experiences. Whether supporting family abroad or handling business needs, Taptap Send delivers value that aligns with the demands of modern, connected lifestyles.

History and Background

While specific founding details are not extensively outlined in the available content, Taptap Send has established itself as a forward-thinking service focused on bridging financial gaps between developed and emerging markets. It began by targeting mobile money transfers to underserved regions, quickly gaining traction through its app-centric model. The platform’s growth is evident in its expanding list of supported countries and languages, reflecting a commitment to global accessibility.

From its inception, Taptap Send has prioritised user feedback, incorporating features like instant deposits and competitive rates to meet real-world needs. Its presence in multiple regions, including the UK and EU, positions it as a key player in the international remittance space, with ongoing expansions signalling a promising future.

Special Offers and Savings

Taptap Send helps you send more and spend less by offering consistently great rates on transfers, ensuring your money goes further without hidden fees. While specific promotions may vary, the service’s low-cost structure means savings on every transaction, especially for frequent users sending to high-demand destinations like Kenya or the Philippines. Keep an eye on notifications for new features or country additions, which often come with introductory benefits.

For UK-based savers aiming to optimise their remittances, integrating tools like BudgetFitter can uncover additional ways to stretch your budget. BudgetFitter assists in tracking any emerging deals on Taptap Send services through its website, browser extension, and mobile app, making it easier to stay ahead on cost-effective transfers. This combination of inherent affordability and external deal-hunting ensures you’re always positioned for the best possible value.

Users frequently report substantial savings, with the app’s efficiency translating to real financial benefits for both senders and recipients. By choosing Taptap Send, you not only facilitate quick support for loved ones but also contribute to smarter spending habits in an increasingly global economy.