Start saving with your personal money saver and receive a £5 reward when you register for a new account with Snoop. Simply sign up to qualify for this great welcome bonus by BudgetFitter Ally Rewards!

Snoop Deals for November 2025

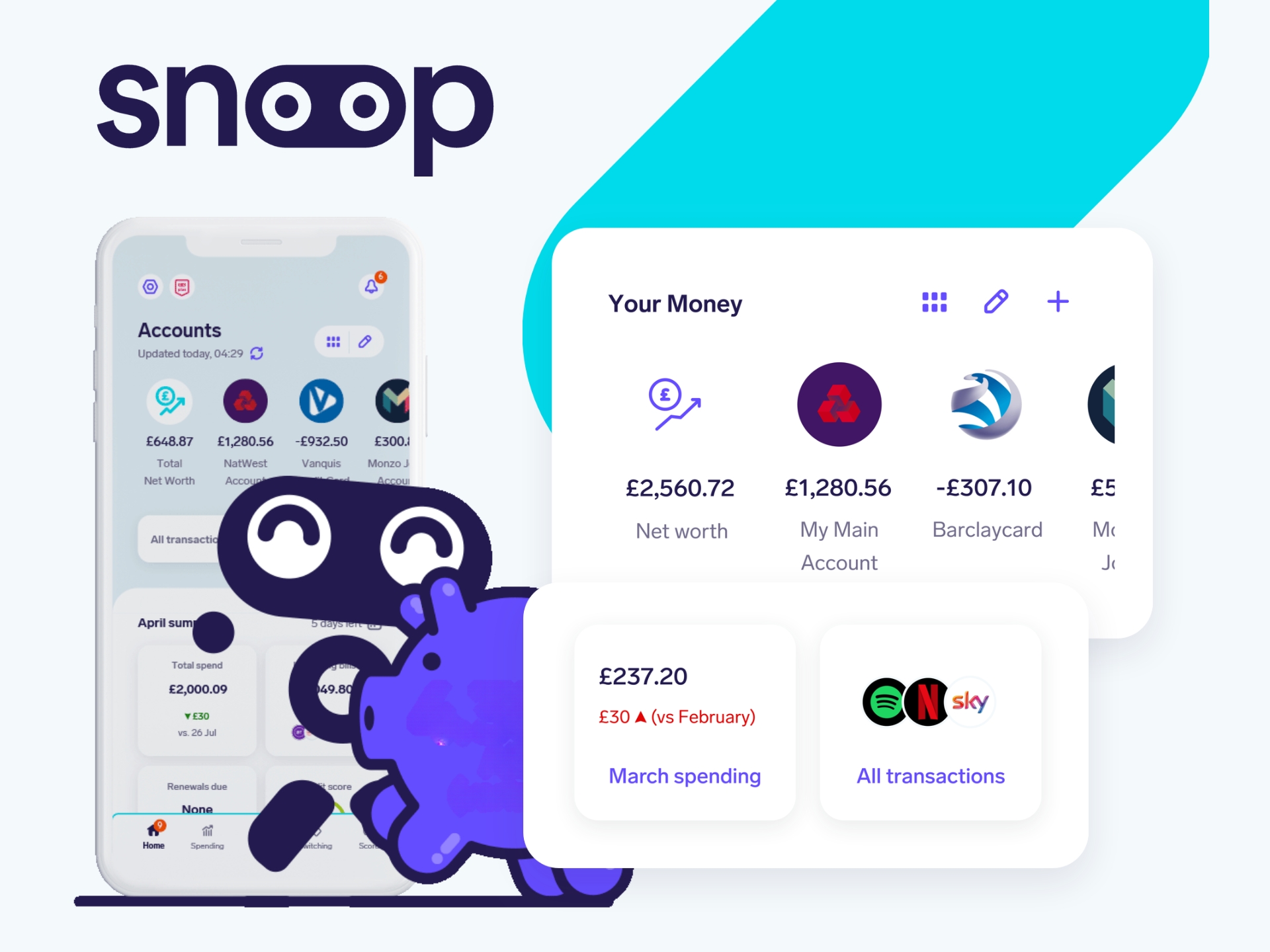

In today’s fast-paced financial landscape, managing your money effectively can feel overwhelming, but Snoop simplifies it all with its innovative money management app. Designed specifically for UK users, Snoop empowers you to track spending, cut costs, and build savings effortlessly through secure technology. Whether you’re aiming to reduce bills or boost your financial confidence, Snoop delivers practical tools tailored to your everyday needs.

What is Snoop?

Snoop is a leading UK-based money management app that helps individuals take control of their finances in a user-friendly way. By leveraging Open Banking technology, Snoop connects securely to your bank accounts and credit cards, providing a unified view of your money without ever accessing your login details. Launched to address the growing need for accessible financial insights, Snoop stands out as a free tool that combines spending tracking, budgeting, and savings features into one intuitive platform.

At its core, Snoop focuses on making personal finance approachable for everyone, from young professionals to families navigating the cost-of-living challenges. The app’s design emphasises simplicity and security, ensuring you can monitor your finances on the go via mobile. With a commitment to helping users save money, Snoop has quickly become a go-to resource for those seeking to optimise their spending habits.

Products and Services

Snoop offers a comprehensive suite of financial services centred around its flagship money management app, available for free download on iOS and Android devices. Key offerings include a savings account integrated directly within the app, allowing you to earn daily interest on your deposits while keeping everything in one place. Additionally, Snoop provides bill-switching services and exclusive deals, even for non-users, to help you find better rates on utilities and subscriptions.

The app also includes credit score monitoring as a core service, giving you free access to your score along with actionable advice to improve it. For those looking to automate their finances, Snoop enables quick setup of budgets and personalised spend analysis based on your transaction history. These services are powered by partnerships with major UK banks, ensuring broad compatibility and reliable performance.

- Savings Account: Open and manage a high-interest account in-app, with easy transfers and daily compounding interest to grow your savings steadily.

- Bill Cutting Tools: Automated scans for overpayments and supplier switches to reduce your monthly outgoings without hassle.

- Spending Tracker: Categorise expenses by merchant or type, compare against previous periods, and receive alerts for unusual activity.

Key Features

What sets Snoop apart are its innovative features designed to deliver real-time financial clarity. The unified account view aggregates all your bank and credit card data into a single dashboard, making it easy to see your overall financial picture at a glance. Personalised spend analysis breaks down your habits by category, such as groceries or entertainment, helping you identify areas for improvement.

Budgeting is a standout with instant setup options – create custom plans or let Snoop suggest ones based on your patterns, all in just two taps. The app’s Snoops feature uncovers savings opportunities at your regular merchants, like vouchers or sales, directly tied to where you shop. Security is paramount, with Open Banking ensuring your data remains protected and notifications alerting you to bill increases or low balances.

Another highlight is the free credit score tracker, which not only displays your score but explains influencing factors and offers tips for enhancement. Snoop also monitors for unused subscriptions and potential refunds, proactively safeguarding your wallet. Setup takes under three minutes via QR code scan, making it accessible for tech-savvy and novice users alike.

Benefits

Choosing Snoop brings tangible benefits, starting with its ability to cut living costs through smart bill tracking and exclusive deals. Users often save hundreds annually by switching suppliers or cancelling forgotten subscriptions, all without leaving the app. The holistic financial overview reduces stress, as you gain confidence from seeing spending trends and budget progress in real time.

For UK customers facing rising expenses, Snoop‘s tools promote better decision-making, like avoiding bank fees or spotting price hikes early. The integrated savings account encourages healthy habits by letting you watch your balance grow alongside daily spending insights. Overall, Snoop fosters financial independence, helping you build a stronger safety net.

Looking to maximise your savings with Snoop? BudgetFitter helps UK shoppers track the latest deals and discounts on financial apps and services. You can find exclusive offers through the BudgetFitter website, browser extension, or mobile app, ensuring you get the most value from tools like Snoop.

History and Background

Snoop was founded in the UK amid the rise of fintech innovations, with a mission to democratise personal finance management. Emerging from the Open Banking revolution, the company quickly gained traction by addressing common pain points like fragmented account views and opaque billing. Today, Snoop supports connections with all major UK banks and continues expanding its features to meet evolving user needs.

Backed by secure technology developed in partnership with financial institutions, Snoop has grown into a trusted name, serving thousands of users who appreciate its no-nonsense approach to savings. The team’s expertise in data analytics ensures the app evolves with user feedback, maintaining its position as a forward-thinking player in the money app space. From its inception, Snoop has prioritised user privacy and empowerment, setting it apart in a crowded market.

Special Offers and Savings

Snoop itself is free to use, with premium options like Snoop+ unlocking advanced features for enhanced savings potential. Users can access exclusive deals on bills and subscriptions, often leading to reductions of up to 20% on utilities through seamless switching. The app’s Snoops regularly highlight time-sensitive vouchers and promotions at popular retailers, directly linked to your spending patterns.

Even without signing up, the Snoop website offers bill comparison tools to spot better deals, making savings accessible to all. For those committed to the app, integrating the savings account means earning competitive interest rates, with balances growing daily. These offers are designed to compound over time, turning small tweaks into significant long-term gains for your wallet.

To amplify these benefits, pair Snoop with deal-hunting resources that align with your financial goals. Regular updates on promotions ensure you’re always in the loop for the best opportunities to stretch your budget further.

In summary, Snoop transforms how you handle money, offering a blend of convenience, security, and savings that resonates with UK users. By downloading the app today, you step into a smarter financial future, equipped to thrive amid economic uncertainties.