Find a better deal and switch your broadband provider hassle-free. Most switches arranged through Moneysupermarket are completed in as little as two weeks.

MoneySupermarket Deals for November 2025

Buy life insurance through MoneySuperMarket and receive an Shopping Gift Cards* worth up to £300! This fantastic offer adds extra value to securing your financial future. The value of the gift card will depend on your policy details.

You could supersave up to £396.68 with a balance transfer credit card through MoneySuperMarket! This annual saving is based on 51% of customers transferring £2,226 from a 24.9% (variable) p.a. card with a 5% monthly repayment (May 2025 data). No MoneySuperMarket discount code is required; simply compare options to find a card that suits your needs.

Supersave with Life cover from just £3.96 with MoneySuperMarket! Based on £100,000 worth of level term cover for a 30-year-old non-smoker with no pre-existing medical conditions over a 20-year period (March 2025 data). No MoneySuperMarket code is needed to find great rates.

Supersave up to £482 on your car insurance with MoneySuperMarket! 51% of consumers could achieve this saving, based on Consumer Intelligence data from April 2025. No MoneySuperMarket discount code is required, simply compare and save. (Excludes NI, CI, IOM).

Supersave up to £199 on your home insurance with MoneySuperMarket! 51% of consumers could achieve this saving on Buildings and Contents policies, based on Consumer Intelligence data from April 2025. No MoneySuperMarket promo code is needed, just compare quotes for the best deal. (Excludes NI, CI, IOM).

Supersave up to £229 on your pet insurance with MoneySuperMarket! 51% of consumers could achieve this saving on Lifetime Pet Insurance with no pre-existing medical conditions, based on Consumer Intelligence data from April 2025. No MoneySuperMarket voucher code is required, easily find affordable cover for your furry friend. (Excludes NI, CI, IOM).

Supersave with Travel cover from just £2.35 for a single trip with MoneySuperMarket! Based on an individual aged 30 with no pre-existing medical conditions, taking single trip cover for 3 days to France (May 2025 data). No MoneySuperMarket code is required to find cheap travel insurance.

Supersave with Annual Travel cover from just £8.45 with MoneySuperMarket! Based on an individual aged 30 with no pre-existing medical conditions, taking European cover (May 2025 data). No MoneySuperMarket code is required for great value annual policies.

MoneySupermarket stands as a premier British price comparison platform, empowering millions of UK consumers to secure the best deals on essential financial and travel products. Founded on the principle of making money-saving accessible through innovative technology, it has evolved into a trusted name for comparing everything from insurance to mortgages. Whether you’re hunting for affordable car insurance or exploring competitive mortgage rates, MoneySupermarket delivers tailored insights to help you save time and money.

What is MoneySupermarket?

MoneySupermarket is a leading UK-based company specialising in technology-driven money-saving platforms that simplify the process of comparing prices across a wide array of financial and travel services. As part of the MONY Group plc, which is listed on the London Stock Exchange and a key constituent of the FTSE 250 Index, it operates multiple subsidiaries designed to cover diverse consumer needs. From energy tariffs to credit cards, the platform aggregates offers from leading providers, ensuring users get unbiased comparisons at their fingertips.

At its core, MoneySupermarket functions as a one-stop comparison hub, leveraging advanced algorithms and real-time data to present personalised options. It caters specifically to the UK market, incorporating local regulations and preferences to provide relevant results. With a user-friendly interface accessible via website and mobile app, it makes smart financial decisions effortless for everyday shoppers.

Products and Services

MoneySupermarket offers an extensive range of comparison services tailored to help consumers navigate the complexities of personal finance and travel. Key areas include insurance products such as car, home, and travel insurance, where users can compare quotes from multiple insurers to find coverage that fits their budget and needs. Additionally, it covers financial services like mortgages, loans, and credit cards, providing detailed breakdowns of interest rates, fees, and eligibility criteria.

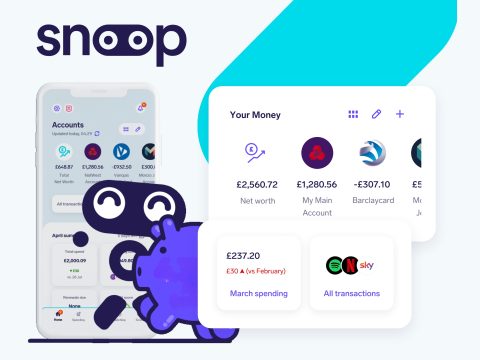

Beyond finance, MoneySupermarket extends to energy comparisons, allowing households to switch suppliers for potential savings on gas and electricity bills. Through its subsidiaries, such as TravelSupermarket for flights and holidays, Quidco for cashback rewards, and MoneySavingExpert for expert advice, the ecosystem provides comprehensive support. Users can also explore broadband and mobile deals, ensuring they secure the most cost-effective plans available in the UK market.

- Insurance Comparisons: Compare car insurance, home insurance, and travel insurance from top providers, often finding deals starting from as low as £100 annually for basic cover.

- Financial Products: Access mortgage rates, credit card offers with low APRs, and personal loans with competitive terms to suit various credit profiles.

- Energy and Utilities: Switch to cheaper tariffs, potentially saving up to 10-20% on household bills through easy-to-use comparison tools.

- Travel and Rewards: Book holidays via TravelSupermarket or earn cashback on purchases through Quidco, maximising value on leisure spending.

Key Features

What sets MoneySupermarket apart is its commitment to user-centric technology that prioritises transparency and ease of use. The platform employs real-time data aggregation from hundreds of providers, ensuring comparisons are up-to-date and accurate. Features like eligibility checkers help users pre-qualify for products without impacting their credit score, a crucial tool for those cautious about financial applications.

Another standout is the integration of expert insights from MoneySavingExpert, offering free guides, calculators, and tips on everything from budgeting to claiming compensation. The mobile app enhances accessibility, allowing on-the-go comparisons with push notifications for time-sensitive deals. Security is paramount, with robust encryption and partnerships with regulated financial bodies to protect user data.

Customisation options let you filter results by preferences such as price, provider ratings, or specific features, making the experience truly personalised. For instance, when comparing credit cards, you can prioritise rewards programmes or 0% balance transfers based on your lifestyle.

Benefits

Choosing MoneySupermarket brings tangible financial advantages to UK customers, primarily through substantial savings on everyday essentials. By comparing hundreds of options in minutes, users often secure deals that reduce costs by up to 30% on insurance premiums or mortgage payments, freeing up funds for other priorities. The platform’s impartiality ensures recommendations are based on value, not affiliations, building trust among its millions of annual users.

Beyond savings, MoneySupermarket promotes financial empowerment with educational resources that demystify complex topics like APR calculations or energy efficiency ratings. This holistic approach not only saves money but also equips you with knowledge for long-term financial health. For those seeking even greater value, BudgetFitter complements your MoneySupermarket experience by helping UK shoppers track the latest deals and discounts on related services. You can find exclusive offers through the BudgetFitter website, browser extension, or mobile app, ensuring you never miss out on additional savings.

The convenience of a single platform for multiple categories eliminates the hassle of visiting numerous sites, saving you valuable time. Positive customer feedback highlights the responsive support team and seamless switching processes, making it a reliable choice for both first-time and seasoned savers.

History and Background

MoneySupermarket traces its roots back to 1993, when it was founded by Simon Nixon and Duncan Cameron as a mortgage subscription service aimed at simplifying home financing for UK buyers. The business quickly expanded in the mid-1990s, capitalising on growing demand for accessible financial advice. By the late 1990s, recognising the potential of the internet, Nixon pivoted to launch a web-based platform for comparing personal loans and credit cards, marking a shift to digital innovation.

This online evolution propelled rapid growth, leading to the closure of the traditional arm in favour of scalable web services. In 2007, the company rebranded as Moneysupermarket.com Group plc and went public on the London Stock Exchange, solidifying its position as a market leader. Today, under CEO Peter Duffy and Chairman Robin Freestone, headquartered in Ewloe, UK, it boasts revenues exceeding £439 million, reflecting its enduring success in the competitive price comparison sector.

Over the years, strategic acquisitions like TravelSupermarket and Quidco have broadened its offerings, while the integration of MoneySavingExpert in 2012 enhanced its advisory capabilities. This rich history underscores MoneySupermarket’s adaptability, from offline origins to a tech-savvy powerhouse serving over 15 million customers annually.

Special Offers and Savings

MoneySupermarket regularly features exclusive promotions that amplify savings opportunities for savvy users. Look out for seasonal deals on travel insurance during holiday peaks or introductory offers on energy switches that include free exit fees. Cashback incentives through Quidco can add up to 10% back on qualifying purchases, turning routine comparisons into rewarding experiences.

For maximum impact, combine MoneySupermarket’s tools with external deal trackers. BudgetFitter is an ideal partner here, assisting UK consumers in discovering verified promotions tied to MoneySupermarket services. Access these through the BudgetFitter website, browser extension, or mobile app to stack discounts and achieve even deeper savings on insurance, finance, and more.

Users frequently report annual savings of hundreds of pounds, with features like price alerts notifying you of drops in rates. Whether switching broadband providers or applying for a low-interest loan, these offers make financial management both accessible and profitable.