Get a £10 bonus when you use this LemFi promo code and send over £50. Enjoy a smooth transfer while saving on fees!

LemFi Deals for November 2025

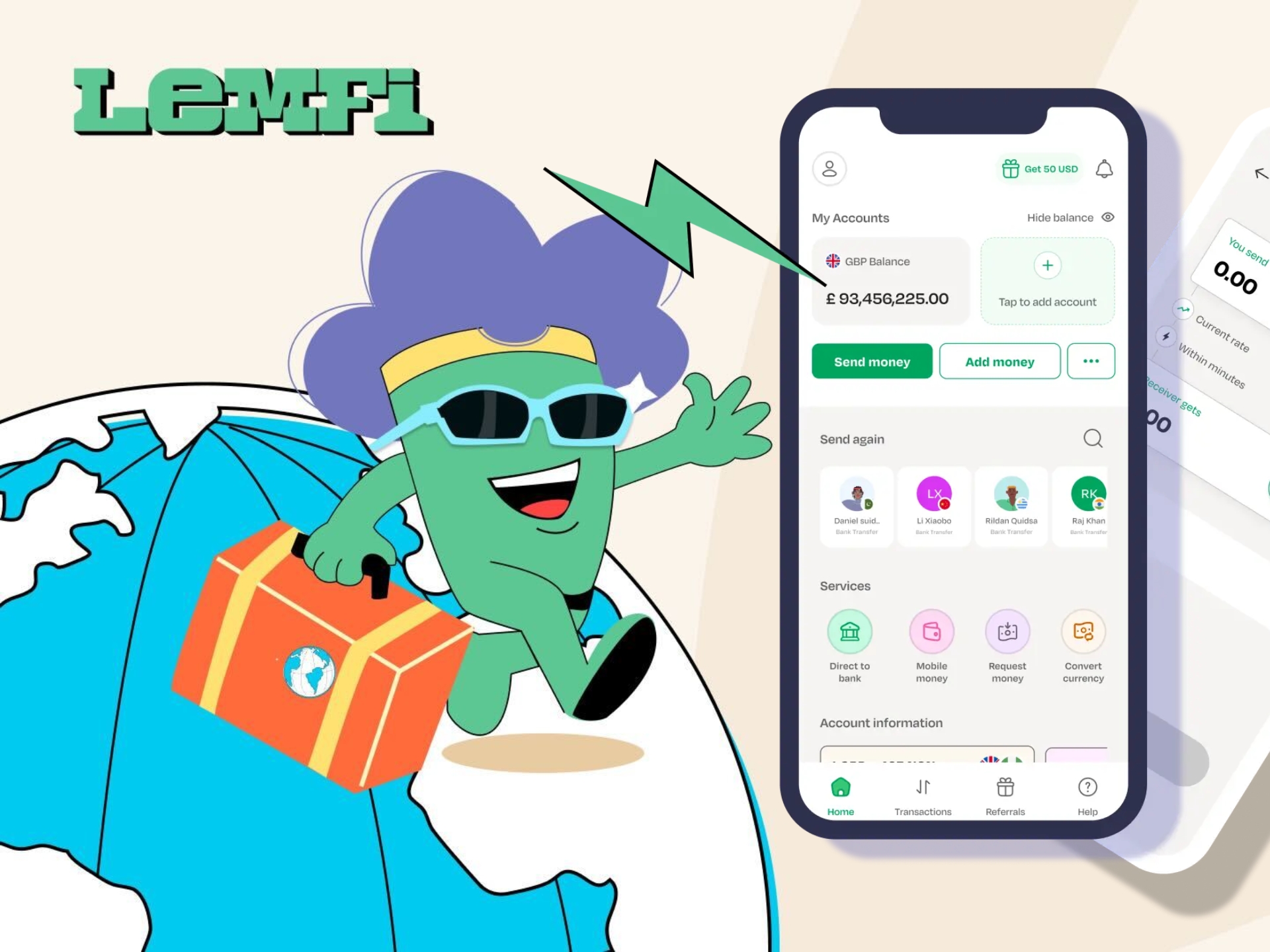

LemFi stands as a revolutionary fintech platform designed to empower immigrants and global users with seamless international payment solutions. By offering tools that simplify cross-border transactions, LemFi helps individuals thrive financially in a connected world. Whether you’re sending money home, managing multi-currency accounts, or building your credit, LemFi provides accessible and efficient services tailored for modern lifestyles.

What is LemFi?

LemFi is a user-centric financial service focused on international payments and banking for immigrants and expats. Launched to address the unique challenges faced by people living abroad, it delivers a comprehensive suite of products that make global money management straightforward and cost-effective. From money transfers to savings accounts, LemFi operates as a one-stop platform available in key regions like the United States, United Arab Emirates, United Kingdom, Europe, and Canada.

At its core, LemFi emphasises financial inclusion by providing tools that were previously out of reach for many. The platform’s intuitive app allows users to handle transactions effortlessly, ensuring that immigrants can support their families back home without the hassle of traditional banking limitations. With a mission to foster financial empowerment, LemFi continues to expand its reach and features to meet the evolving needs of its diverse user base.

Products and Services

LemFi offers a range of innovative products designed to simplify international finance for everyday users. The flagship service is international money transfer, which enables secure and swift payments to over 30 countries worldwide. Users can send funds to family and friends using various methods, including bank transfers and mobile money, all managed through the mobile app.

Another key offering is global accounts, allowing customers to open multi-currency wallets in US Dollars, Canadian Dollars, and Great British Pounds within minutes. These accounts support receiving, holding, and sending money across borders, making it ideal for freelancers or remote workers earning in foreign currencies. Additionally, LemFi’s request money feature lets users generate payment links or requests, perfect for splitting bills or collecting payments from clients via card or transfer.

Beyond transfers, LemFi provides credit access options to help build credit scores in a smarter way, alongside an Instant Access Savings Account for growing savings securely. Currency conversion is seamless, ensuring users get the best value rates without hidden charges. These services are backed by a referral programme, affiliate partnerships, and influencer collaborations to encourage community growth.

- International Money Transfer: Fast transfers to 30+ countries with low fees.

- Global Accounts: Multi-currency support for USD, CAD, and GBP.

- Request Money: Easy payment links for personal or business use.

- Credit and Savings: Tools to build credit and earn on savings.

Key Features

What sets LemFi apart is its commitment to transparency and affordability in every transaction. There are no monthly or subscription fees, no minimum balance requirements, and low foreign transfer fees, allowing users to spend their own money without unnecessary costs. The platform’s mobile-first design ensures quick setup and 24/7 access, with features like real-time notifications and easy tracking of transfers.

LemFi also excels in security and compliance, employing advanced encryption and regulatory adherence to protect user funds. The app’s user-friendly interface, praised for its simplicity, makes it accessible even for those new to digital banking. With high ratings—4.8 on the App Store and 4.6 on Google Play—customers frequently highlight how LemFi streamlines their financial lives.

Further enhancing its appeal, LemFi includes community-driven initiatives like invite-and-earn programmes and promotions that reward loyal users. These features not only add value but also build a supportive network for immigrants navigating global finances.

Benefits

Choosing LemFi means gaining access to reliable, borderless banking that saves time and money on international dealings. For UK-based users, particularly immigrants sending remittances, the platform’s low-fee structure and competitive exchange rates translate to significant savings compared to traditional banks. You’ll enjoy the peace of mind from fast, secure transfers that arrive in recipients’ accounts promptly, often within minutes.

The benefits extend to financial growth, with savings accounts offering competitive interest and credit-building tools that help establish a strong profile abroad. Users appreciate the straightforward app experience, as shared by customers like Shafina, an actor in the UK, who values its simplicity for transfers to Pakistan. Overall, LemFi empowers you to manage your money globally without the barriers of high costs or complexity.

For savvy UK shoppers looking to maximise their financial efficiency with LemFi, BudgetFitter is an invaluable resource. It helps track the latest deals, discounts, and promotions on services like transfers and accounts, ensuring you get even better value. Access these savings effortlessly through the BudgetFitter website, browser extension, or mobile app, making it easy to stay ahead on your international payments.

History and Background

LemFi was founded with a clear vision to revolutionise financial services for immigrants worldwide, addressing gaps in traditional banking that often leave expats underserved. Emerging from a growing need for affordable cross-border solutions, the company quickly established itself as a leader in the fintech space. Its expansion into major markets like the UK, US, and UAE reflects a commitment to scalability and user-focused innovation.

Backed by prominent investors and featured in leading financial publications, LemFi has grown rapidly, amassing a dedicated community of users who rely on its services daily. The team’s expertise in global payments drives continuous improvements, from enhanced security protocols to broader country coverage. Today, LemFi stands as a testament to inclusive fintech, helping millions thrive financially across continents.

Special Offers and Savings

LemFi frequently rolls out exclusive promotions to enhance user value, including zero-fee transfers for first-time users and bonuses through the referral programme. These offers can save you up to 50% on standard transfer fees, making it an attractive choice for regular international senders. Keep an eye on seasonal campaigns that provide extra rewards for savings deposits or credit applications, ensuring your money works harder for you.

For those seeking the best deals on LemFi’s services, exploring partnerships and limited-time discounts can yield substantial savings. The platform’s affiliate and influencer programmes often include perks like cashback or reduced rates, perfect for budget-conscious expats. By staying informed on these opportunities, UK users can optimise their financial strategies while enjoying LemFi’s core benefits.

In a landscape of rising remittance costs, LemFi’s approach to fee-free spending and value-driven promotions positions it as a top pick. Whether you’re a newcomer or a long-term user, these savings elements make managing global finances more accessible and rewarding than ever.

In summary, LemFi transforms the way immigrants and global citizens handle their finances, offering a blend of convenience, security, and savings. With its expanding footprint and user-centric features, it’s poised to remain a vital tool for anyone navigating international payments. Download the app today and experience the difference for yourself.