Earn 200 InstaPoints each when you make your first transfer with Instarem! Sign up using an Instarem referral code to grab this fantastic reward and get more from your initial transaction.

InstaReM Deals for October 2025

Get £10 off your money transfer when you send £1,500 or more with Instarem. Use this Instarem discount code to save on your next large transfer.

Save £5 on your Instarem money transfer when you send between £800 and £1,499. Apply this Instarem promo code to get your discount.

Get £4 off your on your first money transfer with an Instarem voucher code. Save on your transfers while sending money abroad!

About InstaReM

InstaReM is the fast, simple, and secure platform for making international money transfers. As part of the global fintech company Nium, the InstaReM money transfer service offers a transparent and affordable way to send money internationally from UK bank accounts to over 60 countries. The platform is renowned for its low-cost currency exchange rates and minimal fees, helping customers save money compared to traditional banks. Whether sending money to family, paying for services abroad, or managing international business payments, InstaReM provides a reliable solution with its user-friendly website and money transfer app. For new users, an InstaReM voucher code can provide an excellent start, with frequent promotions offering £4 off or more on the first transfer fee.

Why Choose InstaReM?

InstaReM is a trusted choice for millions of customers for several compelling reasons:

- Transparent and Competitive Rates: A key feature is transparency. InstaReM displays its exchange rates and fees upfront, so users know the exact amount their recipient will get before they confirm the transfer, with no hidden charges.

- Low Transfer Fees: The service is known for its low fees, which are often significantly cheaper than high street banks or other remittance providers.

- Fast Overseas Transfers: Many transactions are completed quickly, with funds often arriving in the recipient’s bank account on the same day or the next business day.

- Secure and Regulated: As a major financial technology company, InstaReM is licensed and regulated in all the countries it operates in (including by the FCA in the UK), using robust security to protect all transactions.

- Earn Rewards with InstaPoints: The loyalty programme allows users to earn “InstaPoints” on every transfer, which can be redeemed for discounts on future transaction fees.

Key InstaReM Services

The InstaReM money transfer service is designed for a range of needs:

- Personal Money Transfers: The core service. An easy and affordable way for individuals to send money to family and friends abroad for personal support, education fees, or property payments.

- Business Payments: A dedicated service for businesses, providing a cost-effective platform for making international payment solutions to suppliers, freelancers, and overseas employees.

- Multiple Sending Corridors: Send money from the UK, Europe, Australia, the USA, and more, to over 60 countries across Asia, Europe, and North America.

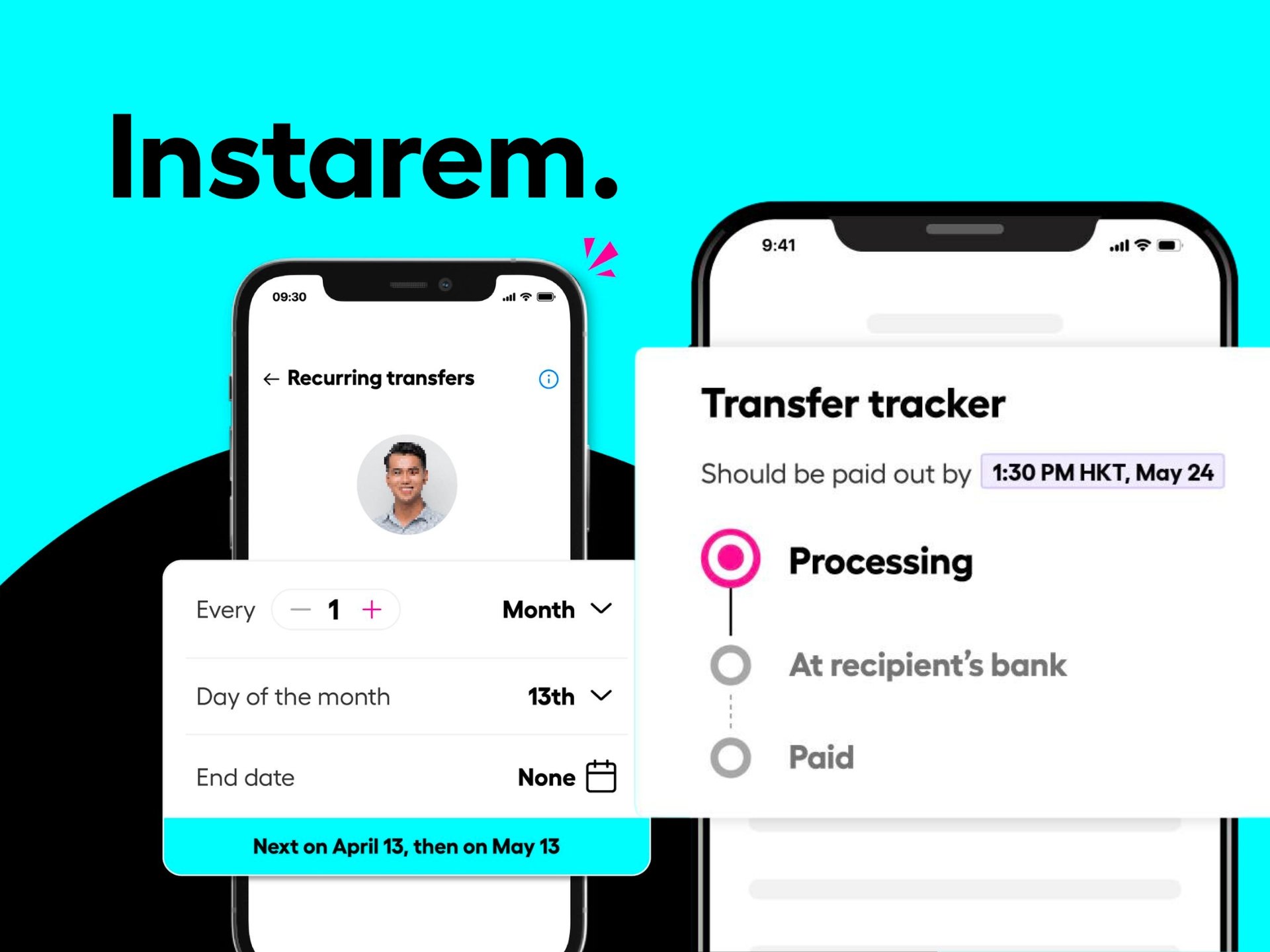

- Money Transfer App: A convenient and highly-rated mobile app for sending money on the go, tracking transfers, and managing an account.

Benefits of Using InstaReM

Using InstaReM to send money internationally from UK offers many significant advantages:

- Save Money on Every Transfer: The combination of competitive exchange rates and low fees means more of a user’s money reaches its destination.

- A Simple and Hassle-Free Process: The fully digital platform makes sending money abroad as easy as a local bank transfer.

- Peace of Mind: The ability to track a transfer from start to finish provides reassurance that the funds are on their way safely.

- No Hidden Surprises: The upfront transparency on rates and fees ensures there are no nasty surprises, a common issue with traditional international bank transfers.

Things to Consider When Using InstaReM

To ensure a smooth transfer, customers should keep a few points in mind:

- Bank Account Transfers Only: InstaReM primarily facilitates bank-to-bank transfers. It does not typically offer a cash pickup option for recipients.

- Verification Process: For security and regulatory reasons, new users will need to complete an identity verification process before they can make their first transfer.

- Transfer Limits: There will be daily or per-transaction sending limits, which can vary by country.

- Voucher Code Conditions: An InstaReM voucher code for “£4 off” will typically be for new customers on their first transfer and may have a minimum send amount.

Tips for a Great InstaReM Experience

Users can get the most value from their transfers with these tips:

- Use a New Customer Offer: For a first transfer, always take advantage of a welcome offer, whether it’s a zero-fee transfer or a monetary discount code.

- Refer a Friend: The referral programme is a great way to earn bonus InstaPoints by introducing new users to the service.

- Check Exchange Rates: The currency exchange rates are live and can fluctuate. It’s always best to check the rate at the time of sending.

- Double-Check Recipient Details: To avoid any delays, meticulously double-check the recipient’s name, bank name, account number, and any required routing codes (like an IBAN or SWIFT code).

InstaReM Customer Support & Policies

InstaReM provides customer support through a 24/7 help centre on their website, with options for live chat and email. As a globally regulated financial service, they have robust security protocols and clear policies on their transactions, fees, and data privacy, providing a trustworthy platform for all fast overseas transfers.

Send Money Smarter with InstaReM

For anyone looking for a fast, secure, and highly affordable way to make international money transfers, InstaReM is a top-tier choice. The platform’s commitment to transparent, low-cost currency exchange and minimal fees ensures exceptional value. With a user-friendly website and a powerful money transfer app, it’s never been easier to send money internationally from UK. New customers should be sure to look for an InstaReM voucher code to get a great deal, such as £4 off their first transfer fee.

Transfer money with speed and confidence with InstaReM!