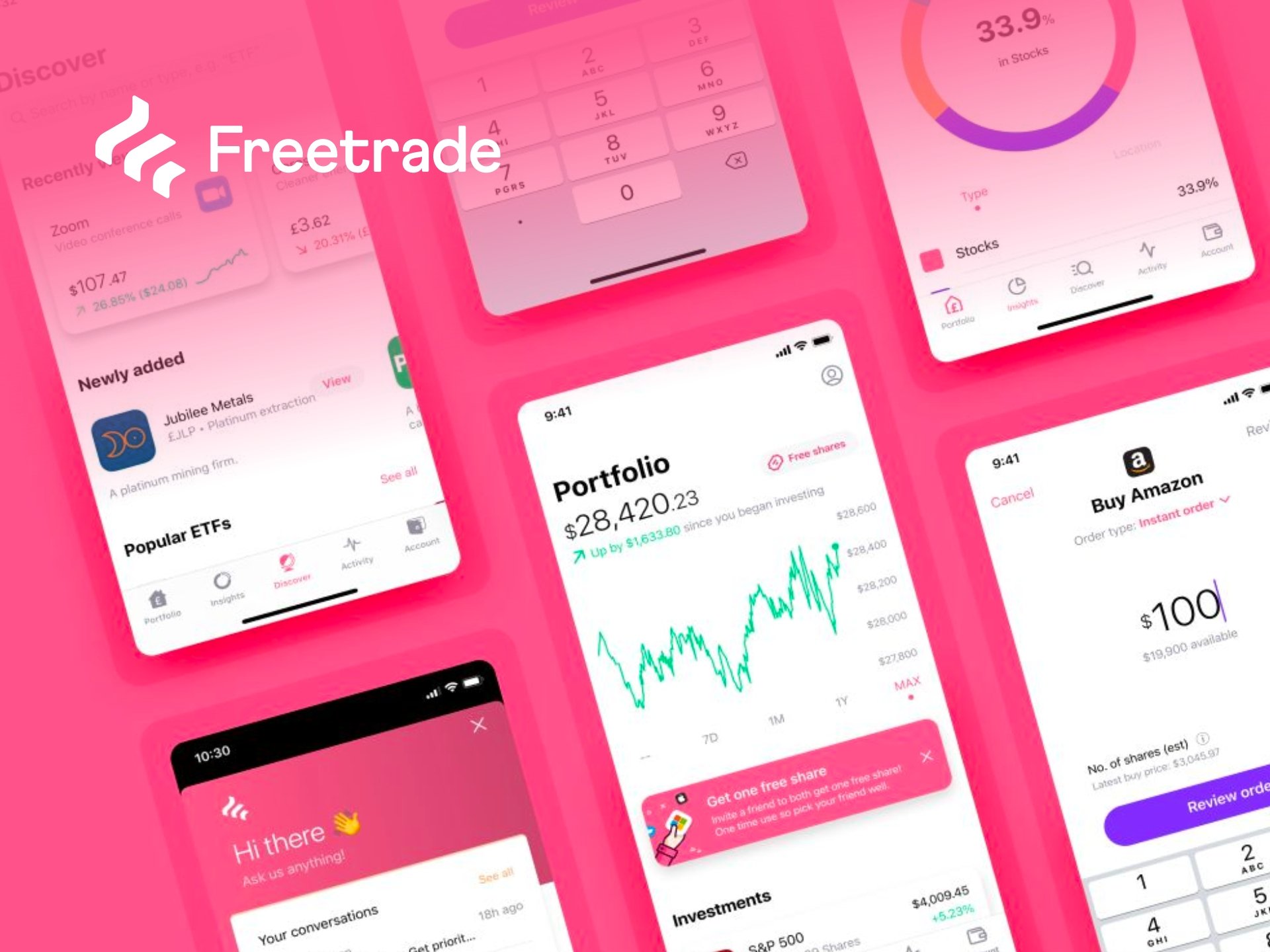

Get FreeTrade free share worth £10 to £100 with a Freetrade referral code. Invest with no upfront cost and watch your portfolio grow!

FreeTrade Deals for November 2025

FreeTrade is revolutionising the way everyday investors in the UK and beyond approach stock trading and investing. As a commission-free platform, it empowers users to build diversified portfolios without the burden of hefty fees, making financial markets more accessible than ever. Whether you’re a beginner dipping your toes into ETFs or a seasoned trader eyeing global stocks, FreeTrade simplifies the process with intuitive tools and tax-efficient options.

What is FreeTrade?

FreeTrade is a pioneering investment app and platform designed specifically for self-directed investors who want to take control of their financial future. Launched to democratise access to financial markets, it offers unlimited commission-free trades on a vast array of UK, US, and European stocks and ETFs. The platform stands out for its user-friendly interface, available on both mobile devices and desktop, ensuring that investing feels straightforward and rewarding rather than overwhelming.

At its core, FreeTrade focuses on eliminating traditional barriers like high brokerage fees and complex account setups. Users can open an account in minutes and start investing with as little as a few pounds, thanks to features like fractional shares. This approach has earned it recognition as the best online trading platform at the British Bank Awards for six consecutive years, reflecting its commitment to reliability and innovation in the fintech space.

What sets FreeTrade apart is its emphasis on long-term wealth building. It provides not just trading tools but also educational resources to help users make informed decisions. From automated investing options to real-time market data, every aspect of the platform is crafted to support smart, sustainable investing for individuals across all experience levels.

Products and Services

FreeTrade offers a diverse range of investment products tailored to different financial goals, ensuring flexibility for every type of investor. The flagship offering is the Stocks and Shares ISA, a tax-efficient wrapper that allows you to invest up to £20,000 annually without worrying about capital gains or dividend taxes. This makes it an ideal choice for UK residents looking to grow their savings sheltered from HMRC.

For retirement planning, the Self-Invested Personal Pension (SIPP) provides tax relief on contributions up to £60,000 per year, with the flexibility to invest in a broad universe of assets. You can contribute based on your income, and the platform supports uncrystallised fund pension lump sums for those nearing retirement age—typically from 55 onwards. Additionally, the General Investment Account (GIA) offers unlimited investing outside of tax wrappers, perfect for those who want to exceed ISA limits or invest without restrictions.

Beyond equities, FreeTrade includes access to government bonds like gilts and UK Treasury bills, providing stable, low-risk options with predictable income through fixed dividends every six months. The platform also supports ISA transfers with attractive incentives, allowing seamless movement of existing investments. All accounts come with direct access to thousands of equities and ETFs, ensuring a comprehensive toolkit for portfolio construction.

Key Features

One of the standout features of FreeTrade is its zero-commission trading model, which applies to unlimited trades across its entire asset universe. This means you can buy and sell fractional shares without fees eating into your returns, making it economical for small-scale investors. The app also earns interest on uninvested cash, helping your money work harder even when it’s not deployed in the markets.

Automated orders and regular investing tools allow you to set up recurring contributions effortlessly, building wealth through dollar-cost averaging without constant monitoring. The platform’s mobile-first design works seamlessly on iOS and Android, with a web version for deeper analysis on desktop. Security is paramount, with robust measures like two-factor authentication and SIPC-like protections for client assets.

Another key highlight is the award-winning platform usability, featuring real-time quotes, portfolio tracking, and educational content to demystify investing. Users appreciate the direct access to gilts and bonds, which add diversification without complexity. Overall, these features make FreeTrade a versatile choice for both novice and experienced investors seeking efficiency and control.

Benefits

Choosing FreeTrade brings a host of benefits that align perfectly with the needs of cost-conscious UK investors. The absence of commission fees translates to significant savings over time, especially for frequent traders, allowing more of your capital to fuel growth. Tax-efficient accounts like the ISA and SIPP help maximise returns by minimising tax liabilities, while the flexibility of a GIA ensures you can scale your investments as your wealth grows.

Customers often praise the platform’s simplicity and transparency—no hidden charges or confusing jargon means you can focus on strategy rather than surprises. With interest on cash balances and low-risk bond options, it’s easier to maintain a balanced portfolio that withstands market volatility. For those starting out, the low entry barrier and fractional shares make investing approachable, turning small, regular contributions into substantial long-term gains.

Looking to save even more on FreeTrade services? BudgetFitter helps UK shoppers track the latest deals and discounts on investment platforms. You can find exclusive offers through the BudgetFitter website, browser extension, or mobile app, ensuring you get the best value from your financial journey.

History and Background

FreeTrade was founded in 2016 by a team of fintech enthusiasts determined to make stock market investing as accessible as online banking. Starting in the UK, it quickly gained traction by challenging the dominance of high-fee brokers, appealing to a new generation of digital-savvy investors. By 2017, it had launched its app, attracting thousands of users with its no-frills, commission-free model.

Over the years, FreeTrade has expanded its offerings, introducing tax wrappers and international assets to cater to a broader audience. It secured significant funding rounds, enabling rapid growth and technological enhancements. Today, it serves over a million users, solidifying its position as a leader in the robo-advisory and trading space, with a focus on empowering everyday people to achieve financial independence.

The company’s ethos revolves around education and inclusion, regularly updating its platform with user feedback to stay ahead of market needs. This evolution from a startup to an award-winning service underscores FreeTrade’s dedication to innovation and customer-centric design.

Special Offers and Savings

FreeTrade frequently rolls out promotions to attract and reward users, such as cashback incentives on ISA transfers—potentially up to £1,000 for eligible new customers until the end of 2025. These offers make switching platforms not just easy but financially advantageous, with terms ensuring clarity on eligibility. The Basic plan includes a free ISA, unlimited trades, and full access to equities and ETFs, starting from as low as possible entry points.

Other savings come through low-risk investments like gilts, which offer stable returns without the fees of traditional brokers. Automated tools reduce the need for paid advisory services, keeping costs down. For maximum value, keep an eye on seasonal promotions that enhance your starting balance or waive setup fees.

To amplify these savings, pair FreeTrade with deal-tracking resources. Savvy investors use platforms that highlight timely offers, ensuring you never miss out on enhanced benefits or reduced entry costs for your investment accounts.

In summary, FreeTrade stands as a beacon for affordable, efficient investing in the UK. Its blend of zero-commission trades, tax-smart accounts, and user-friendly features makes it a top pick for building lasting wealth. Whether you’re saving for a house, retirement, or general growth, FreeTrade equips you with the tools to succeed on your terms.