Claim your first 3 international money transfers for free with a WorldRemit discount code. Enjoy fee-free transfers on your first three transactions!

Money Transfers, Worldwide

WorldRemit Promo Code

verifiedActive Deals & Discounts - August 2025

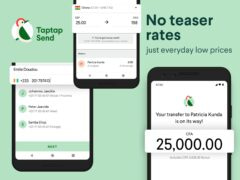

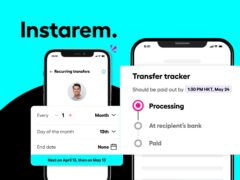

Alternatives to WorldRemit

Explore similar brands to find the perfect deal for your needs.

About WorldRemit

WorldRemit is a leading global company offering a fast, flexible, and secure way to send money online from the UK. As a top-tier international remittance service, the WorldRemit money transfer platform is designed to be low-cost and incredibly convenient for both the sender and the recipient. The platform is a top choice to send money to Africa, Asia, and Latin America, with an extensive network of payout options. A key feature is the huge variety of ways a recipient can get their money, including bank deposits, airtime top-up, and a huge network for mobile money and cash pickup. For new customers, a WorldRemit promo code provides an exceptional start, with a fantastic offer often making the first few transfers completely fee-free.

Why Choose WorldRemit?

WorldRemit is a trusted choice for millions of customers for several compelling reasons:

- Unmatched Payout Flexibility: A major advantage is the huge choice of delivery options. Depending on the country, recipients can receive money as a bank transfer, a cash pickup, a mobile money transfer, or as an airtime top-up.

- Fast and Reliable Transfers: The service is known for its speed, with over 90% of transfers being authorised in minutes, meaning money arrives quickly when it’s needed most.

- Low, Transparent Fees: WorldRemit offers competitive exchange rates and its fees are clearly displayed upfront, so there are no hidden surprises. This makes it a great choice for low-cost global transfers.

- Extensive Global Network: The platform allows users to send money to over 130 countries and choose from over 70 currencies.

- Secure and Regulated: As a major financial technology company, WorldRemit is fully regulated in the UK by the FCA and uses industry-leading security to protect all transactions.

- Generous New Customer Offer: The free transfer offer for new customers is a fantastic, risk-free way to experience the speed and convenience of the service.

Key WorldRemit Services

The WorldRemit money transfer platform offers a comprehensive service for sending money home:

- Bank Transfer: Send money directly and securely to a recipient’s bank account.

- Cash Pickup: An essential service that allows recipients to collect their money in cash from thousands of trusted local agent locations.

- Mobile Money: Instantly send money to a recipient’s mobile money wallet (e.g., M-Pesa, MTN), a hugely popular service in many African and Asian countries.

- Airtime Top-up: A quick and easy way to instantly top up the mobile phone credit of a friend or family member abroad.

- The WorldRemit App: A highly-rated and intuitive mobile app that makes sending money, tracking transfers, and managing recipients incredibly simple.

Benefits of Using WorldRemit

Using this leading international remittance service provides many significant advantages:

- Support Loved Ones with Ease: Provides a fast, safe, and reliable lifeline for sending financial support to family and friends for daily needs, healthcare, or education.

- Convenience for the Recipient: The huge range of payout options ensures that the recipient can access their money in the way that is safest and most convenient for them.

- Save Money on International Transfers: The competitive rates and low fees often result in significant savings compared to using traditional high street money transfer agents or banks.

- Peace of Mind: Real-time updates and notifications for both the sender and receiver provide reassurance that the money has been delivered safely.

Things to Consider When Using WorldRemit

To ensure a smooth transfer, users should keep a few points in mind:

- Verification is Required: For security and regulatory reasons, all new users must complete an identity verification process before sending money.

- Sending Limits: There are sending limits which can be increased once a user has provided additional verification.

- Double-Check Recipient Details: To ensure an instant, hassle-free transfer, it is crucial to check that the recipient’s name, phone number, and bank or mobile money details are correct before confirming.

- Promo Code Conditions: The free transfer offer is for new customers only and applies to the transfer fees on the first few transactions. A specific WorldRemit promo code must be entered.

Tips for a Great WorldRemit Experience

Users can get the most value from the service with these tips:

- Take Full Advantage of the New Customer Offer: The “first three transfers free” deal is the best way to try the service and save money.

- Refer a Friend: The referral programme is a great way to earn a voucher for both the referrer and the new user.

- Use the App for Convenience: The mobile app is the simplest and most convenient way to send money and track transfers on the go.

- Check the “Promotions” Page: The official website often has a dedicated page for current deals and offers.

WorldRemit Customer Support & Policies

As a major global remittance service, WorldRemit provides 24/7 customer support through their official website, with a detailed help centre and contact information. They are fully regulated and have clear, transparent policies regarding their fees, exchange rates, and transaction security, providing a trustworthy and reliable service for millions of users.

A Faster, Safer Way to Send Money

For anyone looking for a modern, secure, and highly affordable way to send money to loved ones abroad, the WorldRemit money transfer service is an exceptional choice. It’s the perfect platform to send money online from the UK, offering a fast and reliable remittance service with great rates. With unparalleled flexibility through its network for mobile money and cash pickup, it’s the best way to send money home. New customers should be sure to use a WorldRemit promo code to get their first transfers completely fee-free.

Send money with speed, simplicity, and love with WorldRemit!